Published: 1 Aug 2024

This think piece sets out a direct relationship between social mobility and innovation, as innovative economies inherently depend on opportunities for upward mobility, where incumbent firms are challenged and new market leaders emerge.

Download a PDF of this report

About the Commission

The Social Mobility Commission is an independent advisory non-departmental public body established under the Life Chances Act 2010 as modified by the Welfare Reform and Work Act 2016. It has a duty to assess progress in improving social mobility in the UK and to promote social mobility in England. The Commission board comprises:

Chair

- Alun Francis OBE, Principal and Chief Executive of Blackpool and The Fylde College.

Deputy Chairs

- Resham Kotecha, Head of Policy at the Open Data Institute.

- Rob Wilson, Chairman at WheelPower – British Wheelchair Sport.

Commissioners

- Dr Raghib Ali, Senior Clinical Research Associate at the MRC Epidemiology Unit at the

- University of Cambridge.

- Ryan Henson, Chief Executive Officer at the Coalition for Global Prosperity.

- Parminder Kohli, Senior Vice President EMEA at Shell Lubricants.

- Tina Stowell MBE, The Rt Hon Baroness Stowell of Beeston.

This commentary was written by:

- Philippe Aghion (College de France, INSEAD, and London School of Economics – LSE)

- Richard Blundell (University College London and Institute for Fiscal Studies)

- Xavier Jaravel (LSE)

The authors are grateful to the Economic and Social Research Council (ESRC) for funding of the underlying research under project ‘Productivity, Wages and the Labour Market’, Grant Reference Number ES/W010453/1.

Foreword

Our aim at the Social Mobility Commission (SMC) is to ensure that everyone is given the opportunity to succeed irrespective of their starting point. But how can we best support that?

Much of the traditional social mobility debate has been about education and its importance to later success. The conventional approach has aimed to improve upward mobility by moving individuals from a lower socio-economic background into professional occupations, usually via prestigious universities. While there is some merit in that approach, it is narrow and limited. It is narrow because it focuses on relatively few people, and ignores the wider issue of improving opportunity overall. It is limited because it is a “zero sum game”. It aims to change the composition of elite groups, without considering wider questions about their role within the economy and society. We argue that policy should take a much broader approach, paying more attention to the supply of opportunities, the obstacles and barriers to entry, and the formation and role of elite groups within the wider political economy.

We commissioned this “think piece” on Innovation and Social Mobility to establish a better framework for thinking about these questions.

Its authors, Philippe Aghion, Richard Blundell and Xavier Jaravel, are experts in this field, and their research illustrates how elite formation relates to innovation, and can act as both a stimulus and an obstacle, depending on the effective functioning of a competitive marketplace. It provides interesting and useful insights into the links between a dynamic economy, the formation of high socio-economic groups, how they are held to account, and the circumstances under which this brings wider benefits and opportunities for all.

The piece sets out a direct relationship between social mobility and innovation, as innovative economies inherently depend on opportunities for upward mobility, where incumbent firms are challenged and new market leaders emerge. Where the incumbents seek to protect their position by creating obstacles and barriers to entry, or otherwise frustrating the competitive process, both social mobility and innovation are frustrated. It also points to the importance of opening opportunities for innovators, in terms of invention and enterprise, so the process of disruptive innovation can flourish. And it suggests that innovative economies are not just better for those at the top end (irrespective of their socio-economic starting point) – but extend their benefits across the economy, including those in lower skilled occupations.

The aim of this “think piece” is not to provide ready-made policy solutions, but to start setting out a framework for thinking about social mobility which can help us address contemporary social mobility challenges more effectively. It is part of a mini-series, which will also address regional disparities and occupational regulation. The aim is to point to some wider issues which policymakers might consider, in order to extend opportunity to more people in more places.

This “think piece” draws attention to the importance of competition policy as a tool for improving social mobility and suggests that education should be accompanied by a stronger focus on innovation, invention and enterprise. This will form a key pillar of our approach to social mobility, which places the economy and the generation of opportunity in a much more central role for the first time.

Our “think pieces” on regional disparities and occupational regulation will open further new ways of thinking about social mobility and the economy, and we hope to publish our new Policy Framework, bringing together our broad recommendations for the economy and education, in the Autumn.

Alun Francis

Chair, Social Mobility Commission

Introduction

The COVID-19 crisis revealed different weaknesses of capitalism on both sides of the Atlantic. In the US it showed the deficiencies of a social system which could not adequately protect the most vulnerable against the consequences of a big aggregate shock. In Europe it revealed the limits of an innovation system which was unable to mass produce ribonucleic acid (RNA) messenger vaccines even though the underlying basic research on the RNA messenger technology had been conducted in Europe.

This contrast illustrates the extent to which the Western world is currently divided between “cut-throat capitalism” and “cuddly capitalism”. The United States exhibits a more cut-throat form of capitalism, more innovative but less protective and inclusive, while countries in Western Continental Europe are representatives of a cuddlier capitalism, more protective and inclusive but less innovative. Are we condemned to choose between being more innovative and being more inclusive?

In this piece, we argue against the ‘either/or’ view, first by suggesting that innovation and social mobility are two sides of the same coin, and second by pointing to policies that can help to move our capitalist systems towards ‘both/and’: more innovativeness and more social mobility. We focus on three such policies – namely, competition policy, education policy and labour market policy.

Fostering innovation to foster social mobility: the role of competition policy

A key idea underlying Schumpeterian growth theory is creative destruction: new innovations replace older technologies and, consequently, destroy the rents that rewarded yesterday’s innovators. These new innovations are closely related to new market entrants. New innovators’ rents increase, while those of incumbent firms decline. Thus, the inventor of Skype was not around 20 years ago, nor was Steve Jobs before the creation of Apple. Hence, a main prediction of the Schumpeterian paradigm is that innovation, especially when it comes from new entrants, is a source of social mobility. This in turn implies that any type of activity by incumbents aimed at increasing entry barriers (for example, lobbying) will dampen the positive effect of innovation on social mobility and should therefore be fought against if the objective is to achieve more inclusive innovation-led growth.

The prediction that more innovativeness should foster social mobility is hinted at by the fact that the most innovative state in the US, California, has a much higher level of social mobility than the least innovative state, Alabama. But a more systematic analysis of the relationship between innovation – and particularly entrant innovation – and social mobility was undertaken by Aghion and others, using patenting and social mobility information across US commuting zones.

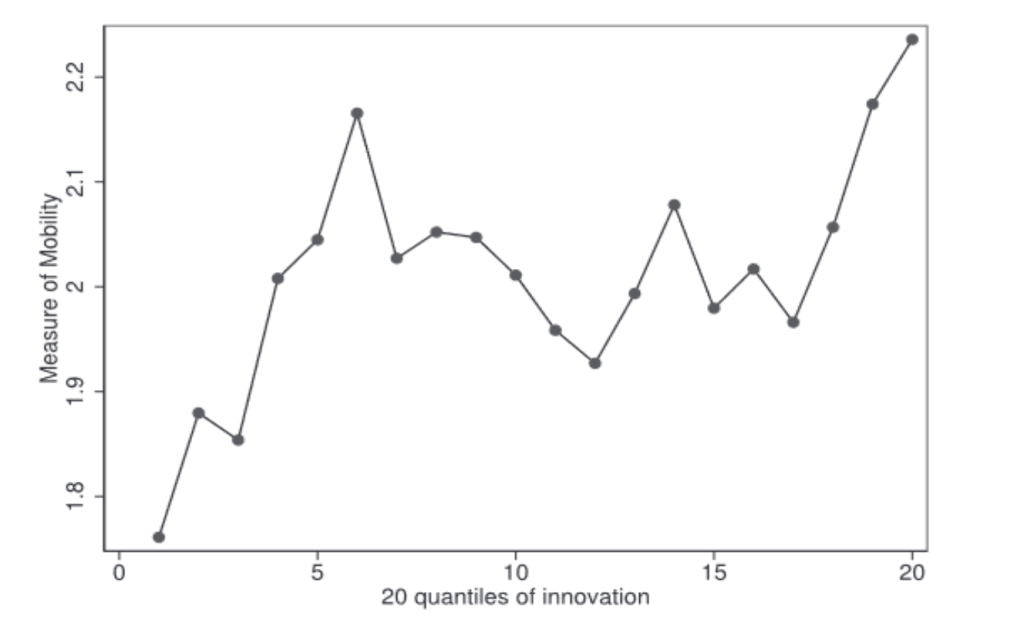

The positive view of social mobility is premised on the notion that individual talent and hard work should not be limited by individual or social background. It is often considered in terms of the probability of an individual from a modest background – that is, someone whose parents were in the bottom 20% of the income distribution in 1996 to 2000 – reaching the top 20% of the distribution when they reached adulthood in 2010. The intensity of innovation is measured by the number of patents filed with the US Patent and Trademark Office per resident in a given commuting zone. Figure 1 shows a positive relationship between innovation and social mobility; moreover, the authors show that this relationship is driven primarily by entrant innovation.

Figure 1: Innovation and social mobility

Source: Aghion and others (2019), Innovation and top income inequality.

Note: This figure plots the percentile in the number of patents per capita (x-axis) against the level of social mobility (y-axis). Social mobility is computed as the probability of an individual belonging to the highest quintile of the income distribution in 2010 (when aged around 30) when their parents belonged to the lowest quintile in 1996 (when aged around 16) and is taken in log. Observations are computed at the commuting zones level (677 observations). The number of patents is averaged from 2005 to 2009.

More precisely, Aghion and others consider separately the effect of ‘entrant innovation’ and ‘incumbent innovation’ on social mobility. They show (1) that entrant innovation has a positive and significant effect on social mobility, whereas the effect of incumbent innovation on social mobility is not significant; and (2) when regressing social mobility on both entrant innovation and incumbent innovation simultaneously, i.e. when performing a ‘horse race’ between entrant innovation and incumbent innovation, all of the effect of innovation on social mobility is associated with entrant innovation, i.e. with creative destruction. This in turn implies that competition policies which foster entry by new innovators should also foster social mobility.

However, during the past two decades the US economy has experienced a rising hegemony of so-called ‘superstar’ firms and a decline in new entries. The most compelling evidence of the superstar phenomenon is provided in work by Autor and colleagues, who show a sharp rise in market concentration in all sectors of the US economy since the early 1980s. As argued by Aghion and others, the rise of superstar firms has been facilitated by the information technology (IT) revolution, which has allowed them to perform a broader range of activities, but also by loopholes in competition policy that have allowed them to expand almost unboundedly through mergers and acquisitions. This in turn explains the observed decline in the entry rate of new firms since 2000, also documented by Aghion and others.

An implication of the analysis is that it is imperative to rethink competition policy, and in particular anti-trust policy regulating mergers and acquisitions, so that technological revolutions, such as IT and artificial intelligence (AI), can boost entrant innovation and growth in both the short run and the long run. The above discussion suggests that by fostering entrant innovation, reforming competition policy should also foster social mobility.

How should we reform competition policy to adapt it to the new IT and AI revolutions? Richard Gilbert observes that American competition policy did not prevent the emergence of superstar firms that managed to acquire or eliminate their potential competitors and discourage the entry of new firms. On the basis of this observation, he recommends moving from a static competition policy, focused on prices and market shares, to a competition policy focused on innovation.

To succeed in this transition, we have to solve a number of problems. First, the predominant approach in anti-trust regulation relies on defining the relevant market and defining market shares. By prohibiting mergers that enable firms to approach a monopoly situation, this approach seeks above all to protect against rising prices. The authorities do not, however, evaluate the extent to which a merger could discourage the entry of new innovative firms, discourage research and development (R&D) investment by competitors, or threaten competition in nascent markets. In other words, anti-trust regulation neglects the dynamic implications of market concentrations. A main dynamic implication is the emergence of superstar firms.

How can we move away from a purely static approach to competition policy? Richard Gilbert believes that it is not necessary to rewrite American anti-trust law, but that its application can be adapted to foster “dynamic competition” – by which he means innovation, the entry of new firms and the creation of new markets. In particular, anti-trust authorities should not use the definition of existing markets as their benchmark. In addition, when they analyse the costs and benefits of a merger, they should consider its anticipated impact on innovation and the creation of new markets. If this new approach had been followed, various mergers by existing superstar firms in the high-tech industry might have been blocked before the merger took place or undone afterwards. In the pharmaceutical industry, Cunningham and colleagues find that about 6% of acquisitions are “kill acquisitions”, where incumbents acquire innovative entrants solely to discontinue their innovative projects and pre-empt future competition.

At the same time, steps should be taken to reduce the lobbying power of vested interests, for example the ‘alleged’ collusion between some judges in the US Supreme Court and some large existing firms.

Fostering social mobility to foster innovation: the lost Einsteins and the role of education policy

Recent studies have pointed to the fact that parental income and/or parental education affect an individual’s probability of becoming an innovator. This in turn leads to a so-called lost Einsteins or lost Marie Curie phenomenon: in other words, highly talented children who could have become innovators if they had been born from wealthy or well-educated parents fail to innovate because they are from poor or less well-educated families. Achievement gaps by socio-demographic background persist even when focusing on the most impactful innovations (for example, highly cited patents). A key reason for these gaps is that better-educated parents transmit knowledge and aspirations to their children, both of which are needed to become an innovator.

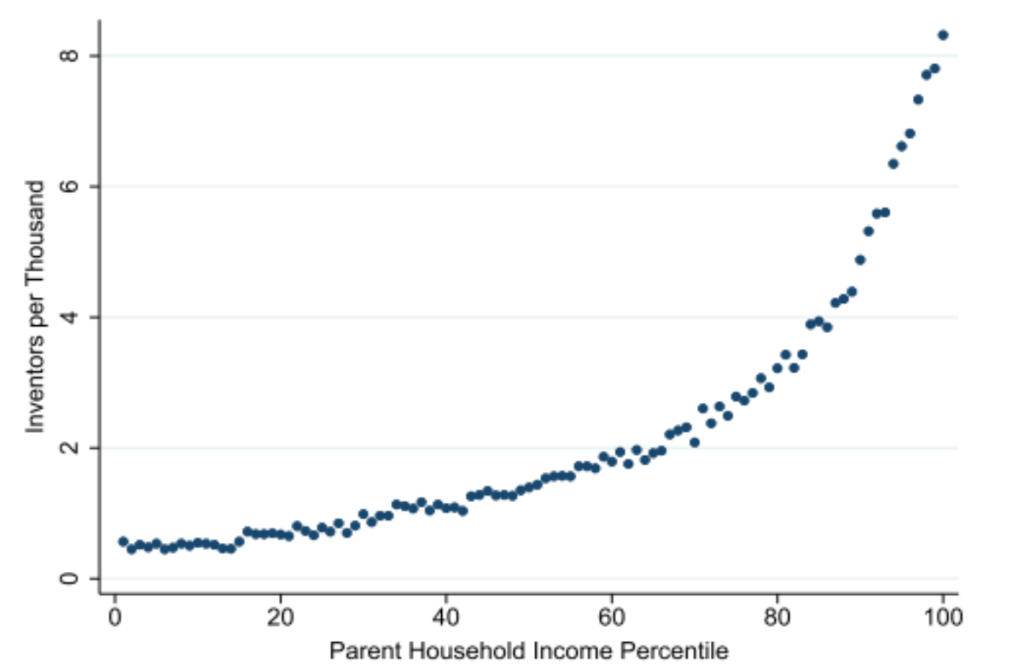

Figure 2 illustrates how the likelihood of a person living in the US obtaining a patent from the US Patent and Trademark Office between 1996 and 2012 is correlated to their parents’ income. Parental income is plotted along the x-axis and divided into hundredths (centiles). For each centile of parental income, the figure shows the percentage of children who will obtain at least one patent during their lifetime. The J-shaped curve indicates that the probability of inventing is very low and increases very little with income when parental income is low. By contrast, the probability of inventing starts to increase sharply with parental income when we get to the upper deciles of the income distribution, in particular the highest 20%. The implication is that there are likely to be many lost Einsteins across the bulk of the distribution, with the majority of innovators coming from a small elite.

Figure 2: Patents and parental income

Source: Bell and others (2019), Who becomes an inventor in America? The importance of exposure to innovation.

Note: This figure plots the number of children (per 1,000 individuals) in the 1980 to 1984 birth cohorts who invented by 2014 against their parents’ income percentile. Parents are assigned percentile ranks based on their mean household income from 1996 to 2000 relative to other parents with children in the same birth cohorts. Inventing by 2014 is defined as being listed as an inventor on a patent application between 2001 and 2012 or applying for or being granted a patent between 1996 and 2014.

To explain the J-curve in Figure 2, there are two considerations. First, parental income affects individuals’ abilities from the outset, creating inherited differences, which are manifested in both ability and inclination towards a career involving innovation. Second, having parents with higher incomes helps a child to overcome different types of entry barriers to becoming an innovator (such as paying for college or funding the initial stages of the firm).

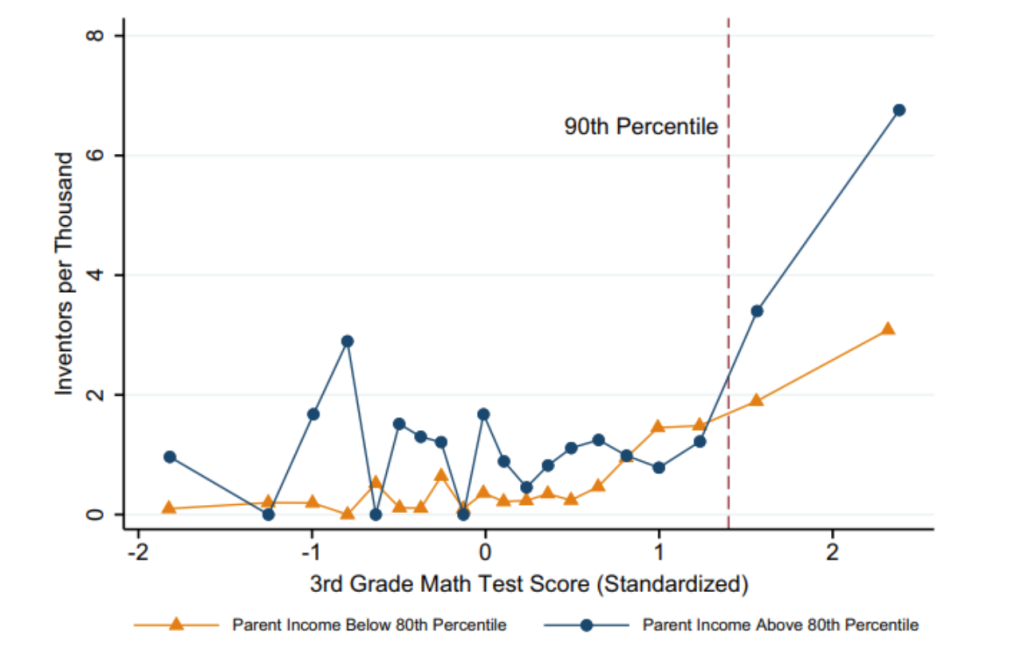

Figure 3 looks at the probability that an individual will invent during their lifetime, with the vertical axis showing the number of inventors per 1,000 individuals, as a function of their intrinsic abilities, represented on the horizontal axis by scores on standardised maths tests in third grade (equivalent to Year 4 in the UK school system). The blue curve models this relationship for children whose parents are in the highest 20% of the income distribution and the yellow curve models the same relationship for all other children. In both cases, the likelihood of becoming an inventor as a function of intrinsic abilities takes the form of a J-curve. In other words, a child of normal ability has a low probability of becoming an inventor, but if the child has exceptional ability the probability increases significantly. The gap between the blue and yellow curves at the extreme right end of the graph demonstrates that for children with equivalent, very high intrinsic abilities, the probability of innovating is far greater if their parents have substantial financial means. The difference is less striking for children of ordinary ability. Overall, this figure therefore confirms the importance of intrinsic abilities and at the same time underscores the importance of parental input in enabling above-average intrinsic abilities to bear fruit.

The difference is less striking for children of ordinary ability. Overall, this figure therefore confirms the importance of intrinsic abilities and at the same time underscores the importance of parental input in enabling above-average intrinsic abilities to bear fruit.

Figure 3: Innovation, ability and parental income

Source: Bell and others (2019), Who becomes an inventor in America? The importance of exposure to innovation.

Note: This figure shows the relationship between patent rates and maths test scores in third grade. The sample consists of children in the 1979–1985 birth cohorts who attended NYC (New York City) public schools in 3rd grade. Test scores, based on standardised tests administered at the district level, are normalised to have mean 0 and standard deviation 1 by year and grade. We divide children into two groups based on whether their parents’ incomes fall below the 80th percentile of the income distribution of parents’ income in the NYC sample. The figure presents a binned scatter plot of patent rates versus test scores for these two subgroups. To construct the figure, we first divide children into 20 equal-sized bins (ventiles) based on their test scores. We then plot the share of inventors (per 1,000 individuals) against the mean test score within each bin for each of the two subgroups.

By parental input we mean not only the financial support that parents provide to finance their children’s studies and careers as innovators, but also the knowledge and aspirations that parents pass on to their offspring.

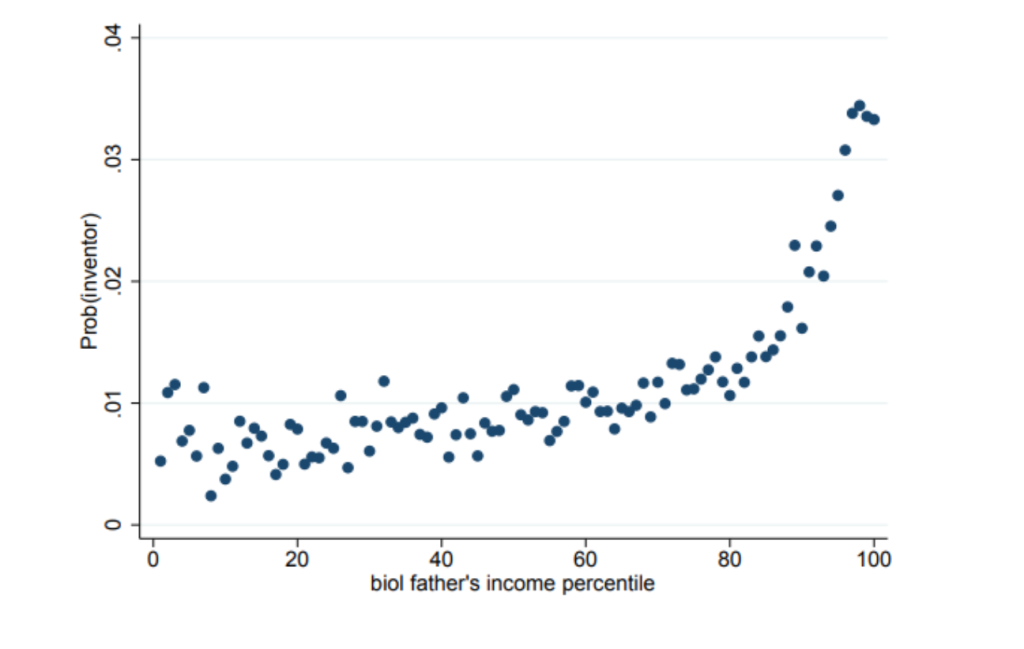

Figure 4 illustrates that monetary income may not be the primary driver of the correlation between parental income and a child’s probability of innovating. Using Finnish data from 1988 to 2012, this figure again shows a J-curve relationship between the father’s income and the likelihood of inventing. This resemblance is more noteworthy because access to education is far more egalitarian in Finland than in the US. The quality of primary and secondary education is excellent, judging by Finland’s Programme for International School Assessment (PISA) scores: Finland ranked seventh out of 77 countries on the 2018 PISA reading tests while the US and France were in 13th and 23rd place respectively. Furthermore, education in Finland is free, from kindergarten through to PhD, and thus universally accessible. How, then, can we explain the resemblance?

Figure 4: Innovation and father’s income in Finland

Source: Aghion and others (2017), The social origins of inventors.

Note: In this figure, father’s income is measured in 1975 for individuals born 1961–1975, and in 1985 for individuals born in 1976 to 1985. We calculate percentile ranks using residuals from a regression of the natural log of deflated income of fathers and mothers on year-of-birth dummies.

It was not until 1970 that Finland reformed its education system to make it truly inclusive. The role of parental income or education was weakened for those individuals who started school after the reform. This in turn suggests that investing in a more inclusive and high-quality education system should both stimulate innovation-led growth and increase social mobility, simply by allowing more talented individuals to become innovators – by reducing the number of lost Einsteins. However, education alone is unlikely to be enough. Potential Einsteins still need to have links to innovators and innovative workplaces.

In his book on the lost Marie Curies, Xavier Jaravel shows that achieving parity between men and women in access to innovation careers would have a large impact on productivity. Specifically, the current productivity growth rate would increase by 80%. For France, this increase in growth would be worth an additional 22 billion euros every year, or 10 billion euros in additional tax revenue. Family background matters just as much as gender: giving equal access to innovation careers to all individuals among the top 1% of the skill distribution – regardless of their family background – would raise the growth rate of GDP by 55%. It is therefore important to realise the potential macro-economic importance of policies that could close the gap in access to innovation careers by gender and socio-economic background.

Another advantage of diversifying the pool of inventors is that as well as increasing the rate of innovation, it also has the potential to affect the direction of innovation. Several historical examples suggest that an innovator’s personal experience shapes their entrepreneurial vision, and thus so does the inequality across the socio-demographic groups that benefit from these innovations. In short: innovators often focus on solving issues faced by people like themselves. For example, in the late 19th century, a wealthy American, Josephine Cochrane, received a patent for her “Dish Washing Machine” as she wanted to protect her fine china, which her maid kept damaging by hand-washing it.

Beyond historical anecdotes, recent work shows statistical evidence from a range of innovations – from medical innovation to phone apps and consumer packaged goods – that innovators tend to cater to people like themselves. For example, innovators from a high-income family are more likely to invent products purchased by high-income consumers: they are less likely to get a patent or start a firm in a ‘necessity’ industry such as food and more likely to do so in a ‘luxury’ industry such as finance. Similar patterns exist in terms of gender and age. Feng and others show that these patterns have a sizeable impact on purchasing-power inequality across consumer groups.

Many policies can be leveraged to attract untapped talent into innovation careers and to diversify the pool of innovators. There is now mounting evidence that promoting innovation requires moving beyond general human capital policies and providing specific exposure to innovation careers. For example, Bell and others show that proximity to inventors in childhood has a causal effect on the probability of becoming an inventor. Recent randomised control trials have shown the importance of mentoring programmes and role model effects to career choice. Breda and colleagues study science, technology, engineering, and mathematics (STEM) fields, which play a key role in promoting innovation. They find that brief exposure to female role models working in scientific fields has a large impact on the choice of undergraduate major for girls. They find a very large impact on high-achieving girls in 12th grade, who are more likely to enrol in selective and male-dominated STEM programmes in college.

Thus, a key policy priority is to find the lost Einsteins and lost Marie Curies, to broaden the pool of innovators. Education policies play a central role in this agenda. A more inclusive education system can also help to speed up the pace of diffusion of innovations. While the lost Marie Curies agenda focuses on the creation of technologies, it is equally important for productivity growth to better diffuse existing technologies. A better-educated workforce is better able to adopt new technologies. Therefore, reducing the education achievement gap between socio-demographic groups and between local areas can also help to speed up the diffusion of innovation, while reducing inequalities. For example, Nimier-David has studied the massive construction of new colleges in France in the 1990s and documented that firm creation and labour productivity increased in areas with access to better education; these impacts were found within five years of establishing new colleges.

Overall, we are not condemned to choose between innovation and growth on the one hand and social mobility on the other: we can activate forces that both foster innovation-based growth and increase social mobility, namely by constantly favouring the entry of new innovative firms and the emergence of new talents.

Fostering innovation to promote social mobility in the labour market

A final question is the impact of innovation on social mobility through the labour market.

Are innovations, such as automation, likely to lead to mass unemployment? The empirical evidence to date suggests the contrary. Instead, recent innovations – from AI to automation – appear to increase labour demand and create jobs. The adoption of new technologies can enhance employment through an increase in demand via lower prices and increased average real incomes.

However, there can be changes in the distribution of opportunities across workers. Innovation creates a demand for new skills in occupations that are complementary to the new technologies. At the same time, some older occupations are replaced or downgraded. Through this process of creative destruction, workers who have skills that are complementary to the new technologies will see their wages rise and their job opportunities improve.

This creative destruction process is the mechanism whereby innovation can enhance social mobility in the labour market. However, workers who do not have the requisite complementary skills, or who do not match with a firm that has adopted new technologies, will see little improvement in the quality of their jobs and little growth in their wages. In areas where workers have few opportunities to match with good firms, training and education alone are unlikely to be enough to generate good-quality jobs with access to career opportunities.

A first conclusion is therefore that rather than slowing down technology (for example by taxing robots), policy-makers should aim to prepare their employers to adopt new technologies, particularly those that complement existing worker skills, and to upgrade skills that complement new technologies. The policy priority should be to leverage the power of innovation to enhance social mobility. Slowing down the pace of technology diffusion would be likely to reduce labour demand and generate unemployment, especially if other countries adopt innovations faster.

How to proceed? Enhancing social mobility in the labour market requires both the right set of skills and access to those firms that have adopted new technology – that is, a match between the worker and an innovative firm. Several recent papers help to demonstrate the key role of firms in innovation dynamics and worker outcomes.

First, average wages typically rise in firms that innovate and adopt new technologies. This positive effect of firm innovation on workers’ wages can lead to wage inequality between firms as firm productivity becomes more dispersed. Second, workers in laggard firms may lose their jobs while more innovative firms expand. Third, the distribution of the ‘innovation rents’ across workers in a firm sometimes leads to an increase in within-firm inequality. For example, Kline and colleagues look at who profits from patents within the firm and, using linkages between patent applications with business and worker tax records, the role of skill complementarities, ownership and bargaining power. Their findings imply that the largest earnings gains are concentrated among workers in the top half of the earnings distribution. Other studies have found that adopting new technologies sometimes leaves within-firm wage inequality unchanged.

Although several studies have found that innovations are skill biased, favouring workers with cognitive skills associated with high-level qualifications in STEM, a recent literature finds that many new technologies do not appear to be tilted toward these skills, including work on automation. This may well reflect that it is not just cognitive skills which complement new technologies. For example, it appears that social skills – teamwork, coordination and decision-making – are increasingly being rewarded. Deming argues that social skills increase productivity because they reduce the cost of trading tasks with other workers. Analytical skills remain important, but there is a significant role for social skills and interpersonal interaction.

Non-cognitive skills play a key role in the successful exploitation of IT technology, where communication, collaboration, organisation, dependability, flexibility and problem-solving are rated as the top skills that employers want in their employees. This increasing focus on social skills may reflect the idea that they cannot easily be replaced through automation. There is a downside to social skills too. Unlike STEM subjects, they are difficult to measure and verify. Indeed, the fact that we see little formal training in social skills suggests that they are difficult to formally accredit outside direct engagement.

Workers who rely on routine or physical skills are among those who have been least able to exploit the gains from technology. More than between high-skilled and low-skilled workers, the innovation divide is between very specific types of skills; for example, low-income workers specialised in routine skills will likely lose out as a result of innovation, while low-income workers with good social skills will likely be among the winners.

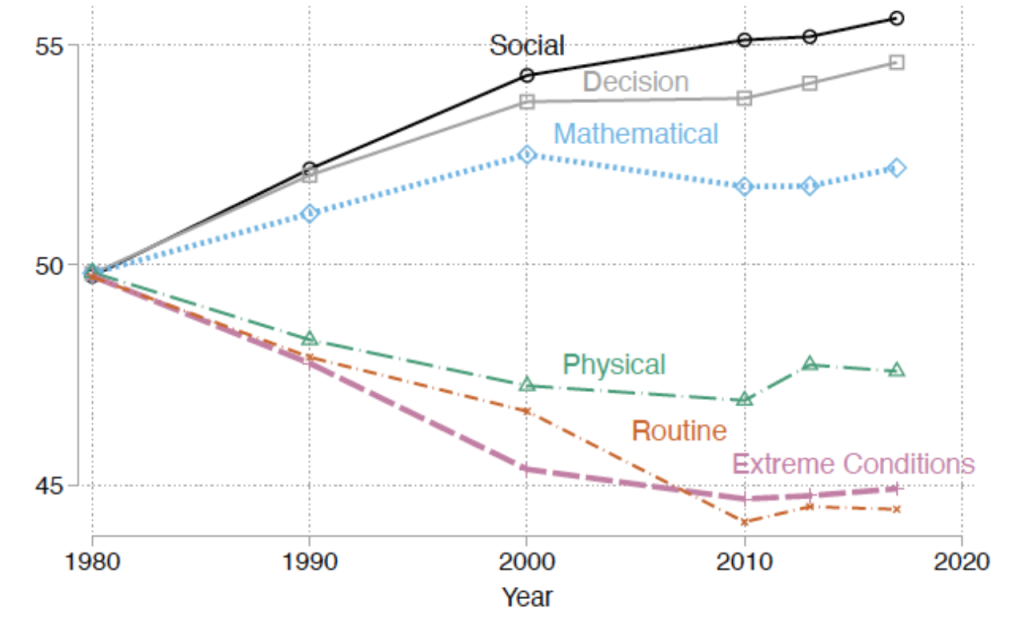

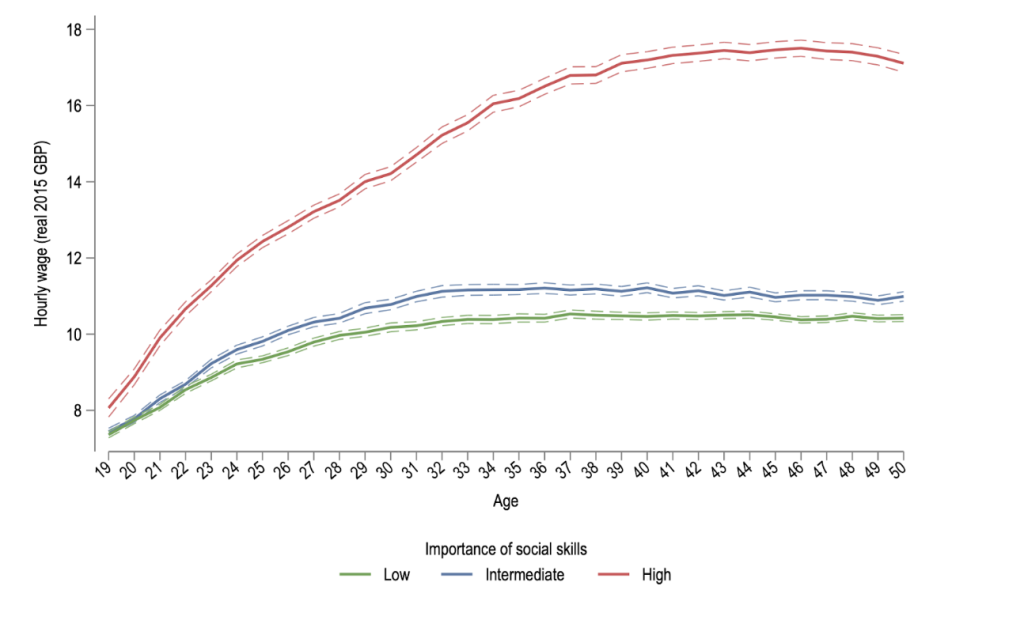

Quite strikingly, the trends in employment by occupational task intensity for US men, presented in Figure 5, show that the highest upward trends are in social, decision-making and mathematical skills, with strong declines for physical, routine and ‘extreme’ skills. Similar changes in employment by task intensity have also been found in the UK. This latter study takes the analysis one step further and, using matched employer/employee data for the UK, shows that even among less-educated workers, occupations requiring social skills deliver higher wages and steeper career progression (see Figure 6). The wage profile is further enhanced in firms that also employ a large fraction of more highly educated workers, typically productive and innovative firms.

Figure 5: Trends in US employment task Intensity

Source: Páez, D.G. (2023), The changing nature of work, old-age labor supply, and social security, Job Market Paper, 7 November, https://wdanielgiraldop.github.io/mywebsite/Giraldo_Paez_JMP.pdf.

Note: This figure shows the mean task intensity in the Census and American Community Survey over time among all workers aged 20 and older. Data are from the 5% sample of the 1980, 1990, and 2000 Censuses and the 2008–2010, 2011–2013 and 2013–2017 multi-year samples of the American Community Survey. Tasks are constructed from O*NET scales. The measures are rescaled so that they are expressed in centiles of the 1980 task distribution.

The challenges in the UK labour market are particularly severe. For the majority of less-educated workers in the UK, jobs provide negligible wage growth, little training and poor career prospects. For these workers, employment has not been enough to create good opportunities for career progression and social mobility. Even educated workers have seen sluggish productivity growth in the UK since the financial crisis of the late 2000s, and real earnings growth has been subdued. Rates of progression up the occupational wage ladder in the early years of people’s careers had tended to increase across successive generations, for both men and women – but this trend came to an end for those born in the 1980s. This means that recent cohorts of new workers in the UK have both started lower down the occupational ladder than their predecessors and climbed it more slowly. This has happened against a backdrop of high levels of earnings inequality and stagnant real wage growth.

Figure 6: Wage profile by age and social skill intensity for less-educated male workers

Source: Aghion and others (2023), Social skills and the individual wage growth of less educated workers.

Note: Data from Annual Survey of Hours and Employment (ASHE) 2004 to 2019. Figure shows average hourly wage by age for less-educated male workers in private sector firms in occupations with education levels drawn from the linked 2011 Census data, split by the soft skill index in three equal bins.

To benefit from innovation, workers should have access to work in innovative firms. The strongly skewed distribution of innovative firms in the UK make the matching of workers with innovative workplaces all the more difficult. This is particularly challenging in the UK labour market, where there is a small group of highly productive and geographically concentrated firms. Significant geographic differences in wages and education characterise the UK. Not only are high-skilled jobs spatially concentrated but they steadily became more so between 1998 and 2019.

Educational attainment in London and the South East outstrips that in much of the rest of England, with the share of adults with degrees ranging from 15% in northern cities to 55% in London and other cities in the South East (namely, Brighton). London benefits from both better educational performance and lower inequality than other parts of the country. Social mobility in London is higher too, with the disadvantage gap in exam performance in inner London less than half as wide as that in the rest of the country. There remain large parts of the UK with low general levels of education and few innovative firms. In these areas, there are limited opportunities for workers to match with innovative workplaces and there is little access to careers in innovation for talented young people.

Mobility to successful cities is a route to social mobility, and many cities in the UK – such as London, Brighton and Bristol – gain large numbers of graduates through migration. These cities already have relatively high levels of higher education participation. Poorer children in London do much better than poorer children elsewhere in the UK in terms of education attainment and adult labour market outcomes. In contrast, many places with low levels of higher education participation, such as Grimsby or Wisbech, further lose graduates through migration. However, the effect of higher education on economic and geographic mobility is much weaker for those with low socio-economic status (SES) backgrounds. Not only are they less likely to go to university; they are also less likely to move to a thriving city if they do go to university.

In sum, the extreme geographic concentration of productive firms in the UK means that there are far fewer opportunities for workers to match with innovative workplaces elsewhere. High-ability students from low SES backgrounds outside London find it increasingly hard to build their careers through a move to London. Housing costs alone are an issue, and with little financial backing from parents they are much less likely to move to London. They also seem to choose less innovative courses when they do go to university.

A well-designed policy response to these limitations on social mobility in the labour market requires a refocusing of education, training and competition policies to enhance entrant innovation – but also devising ways to attract innovative firms to neglected areas. One policy response, therefore, is to build additional innovation hubs, or at least to attract firms that adopt new technologies around the UK’s other large university clusters outside London, in Manchester, Birmingham and elsewhere. The goal is certainly not to reduce the level of innovation in London; rather, it should be to increase opportunities beyond the capital – not in every location, but more widely across the UK. This requires a combination of human capital policy and competition/entry policy.

As a word of caution, we note that new technologies typically result in greater occupational segregation. That is, it becomes more profitable for a firm that has adopted a new technology to outsource certain occupations that are not complementary with this technology. Cleaning, catering, transport and other low-skilled manual and routine occupations are classic examples. To an extent, we have already seen this happening in London. If innovation and new technologies are to benefit a broad group of workers, not just the highly skilled, then workers will have to be trained in skills that are complementary to these new technologies. Social skills are a leading example of such complementary skills. Likewise, incentivising new technologies that complement, or augment, workers’ skills will be of wider benefit for all workers.

Reflections on directions for policy

A main conclusion from our discussions in this Think Piece is that we do not have to choose between fostering innovation-based growth and fostering social mobility. There are several clear policy priorities to promote both simultaneously.

First, competition policy should be reformed to make it focused less on static criteria such as market share and market definition and more on dynamic aspects, starting with entry and innovation. This should foster both productivity growth and social mobility by favouring entrant innovation.

Second, the education system should be reformed to minimise the number of lost Einsteins and Marie Curies. This calls for policies to help all students discover and pursue careers in science, research and innovation. A wide set of policy tools could be deployed, including work experience and mentoring programmes. This should make the economy more innovative by increasing the pool of potential innovators, and it will also make the economy more inclusive by increasing the scope for upward social mobility to the top of the income distribution (via innovation careers).

Third, policies should be promoted that raise the general level of education, which in turn helps to speed up the diffusion of innovation. The commonalities between the 1970 educational reform in Finland, the recent educational reforms in Portugal and Germany, and the experience of the ‘no excuse’ charter schools in the US suggest a concrete way forward.

Fourth, slowing down the pace of diffusion of technology (such as with a tax on robots or AI) appears to be self-defeating. Innovative firms are also productive firms that pay higher wages and provide better career opportunities – including, more often than not, for low-skilled workers. Incentivising innovations that augment workers’ skills and provide them with skills that complement new technologies is the most effective way to harness the social value of innovation.

Fifth, we need labour market and training policies to provide workers with the right skills and reap the benefits of innovation. Opportunities to adopt innovation and move up are sometimes less available for less-educated workers. For these workers, it is about improving not just their ‘hard’ educational skills but also ‘soft’ skills, in particular their ability to engage in teamwork with other employees within the firm. These are skills that complement new technologies. Empirical analysis of the effect of training on longer-term labour market outcomes suggests a focus on firm-based qualification training with an emphasis on a match with a productive firm, as examined in work on sector-focused training interventions.

Once again, fostering innovation and innovating firms should favour upward social mobility: indeed, innovative firms pay higher wages and provide better career opportunities, with reasonable wage growth and access to training. It is therefore crucial to help all workers match with these firms, perhaps by attracting innovative firms to locations where innovations have historically diffused slowly.

It is important to be realistic about the challenges in turning around geographic areas of low innovation and poor productivity. London has become a success story for innovation and social mobility, with a high share of children going on to higher education and a disadvantage gap in exam performance less than half as wide as that in the rest of the country. At the same time, London has long been the top city for start-ups in the UK. The example of the capital shows that improving the level of economic dynamism takes time and requires a combination of educational success, role models in innovation and productive workplaces, opportunities for worker mobility, access to finance for start-ups, and the ability to attract world-class talent from around the UK and further afield.

Despite these challenges, we are optimistic that by bringing together these five policy priorities, it will be possible to both increase the rates of innovation and strengthen social mobility.

Bibliography

Acemoglu, D. and Cao, D. (2014). Innovation by entrants and incumbents. Journal of Economic Theory, 157, 255–294.

Acemoglu, D. and Restrepo, P. (2020). Robots and jobs: evidence from US labor markets. Journal of Political Economy, 128(6), 2188–2244. https://doi.org/10.1086/705716.

Acemoglu, D., Robinson, J.A. and Verdier, T. (2017). Asymmetric growth and institutions in an interdependent world. Journal of Political Economy, 125(5), 1245–1305. https://doi.org/10.1086/693038.

Aghion, P., Antonin, C. and Bunel, S. (2021). The power of creative destruction: economic upheaval and the wealth of nations. In The power of creative destruction. Harvard University Press. https://doi.org/10.4159/9780674258686.

Aghion, P., Akcigit, U., Bergeaud, A. Blundell, R. and D. Hemous (2019). Innovation and top income inequality. The Review of Economic Studies, 86(1), 1–45. https://doi.org/10.1093/restud/rdy027.

Aghion, P., Akcigit, U., Hyytinen, A. and Toivanen, O. (2017). The social origins of inventors. Working Paper 24110. National Bureau of Economic Research. https://doi.org/10.3386/w24110.

Aghion, P., Antonin, C., Bunel, S. and Jaravel, X. (2022). The effects of automation on labor demand: a survey of the recent literature. SSRN Scholarly Paper. https://papers.ssrn.com/abstract=4026751.

Aghion, P., Bergeaud, A., Blundell, R.W. and Griffith, R. (2019). The innovation premium to soft skills in low-skilled occupations. SSRN Scholarly Paper. https://doi.org/10.2139/ssrn.3489777.

Aghion, P., Bergeaud, A., Blundell, R.W. and Griffith, R. (2023). Social skills and the individual wage growth of less educated workers. SSRN Scholarly Paper. https://doi.org/10.2139/ssrn.4578419.

Aghion, P., Bergeaud, A., Boppart, T., Klenow, P.J. and Li, H. (2023). A theory of falling growth and rising rents. Review of Economic Studies, 90(6), 2675–2702. https://doi.org/10.1093/restud/rdad016.

Aghion, P., Blundell, R., Griffith, R., Howitt, P. and Prantl, S. (2009). The effects of entry on incumbent innovation and productivity. The Review of Economics and Statistics, 91(1), 20–32. https://doi.org/10.1162/rest.91.1.20.

Akerman, A., Gaarder, I. and Mogstad, M. (2015). The skill complementarity of broadband internet. The Quarterly Journal of Economics, 130(4), 1781–1824. https://doi.org/10.1093/qje/qjv028.

Autor, D.H. and Dorn, D. (2013). The growth of low-skill service jobs and the polarization of the US labor market. American Economic Review, 103(5), 1553–1597. https://doi.org/10.1257/aer.103.5.1553.

Autor, D.H., Mindell, D.A. and Reynolds, E. (2023). The work of the future: building better jobs in an age of intelligent machines. MIT Press.

Autor, D., Salomons, A. and Seegmiller, B. (2023). Patenting with the stars: where are technology leaders leading the labor market? Discussion Paper 2023.05. MIT Blueprint Labs.

Autor, D., Dorn, D., Katz, L.F., Patterson, C. and Van Reenen, J. (2020). The fall of the labor share and the rise of superstar firms. The Quarterly Journal of Economics, 135(2), 645–709. https://doi.org/10.1093/qje/qjaa004.

Beaudry, P., Doms, M. and Lewis, E. (2010), Should the personal computer be considered a technological revolution? Evidence from U.S. metropolitan areas, Journal of Political Economy, 118(5), 988–1036, https://doi.org/10.1086/658371.

Bell, A., Chetty, R., Jaravel, X. Petkova, N. and Van Reenen, J. (2019). Who becomes an inventor in America? The importance of exposure to innovation. The Quarterly Journal of Economics, 134(2), 647–713. https://doi.org/10.1093/qje/qjy028.

Blundell, R., Dearden, L., Meghir, C. and Sianesi, B (1999). Human capital investment: the returns from education and training to the individual, the firm and the economy. Fiscal Studies, 20(1), 1–23. https://doi.org/10.1111/j.1475-5890.1999.tb00001.x.

Blundell, R., Joyce, R., Norris Keiller, A. and Ziliak, J.P. (2018). Income inequality and the labour market in Britain and the US. Journal of Public Economics, 162, 48–62. https://doi.org/10.1016/j.jpubeco.2018.04.001.

Breda, T., Grenet, J., Monnet, M. and Van Effenterre, C. (2023). How effective are female role models in steering girls towards STEM? Evidence from French high schools. The Economic Journal, 133(653), 1773–1809. https://doi.org/10.1093/ej/uead019.

Brynjolfsson, E., Li, D. and Raymond, L.R. (2023). Generative AI at work. Working Paper 31161. National Bureau of Economic Research. https://doi.org/10.3386/w31161.

Chetty, R., Friedman, J.N., Hendren, N., Jones, M.R. and Porter, S.R. (2018). The opportunity atlas: mapping the childhood roots of social mobility. Working Paper. National Bureau of Economic Research. https://doi.org/10.3386/w25147.

Cortes, G.M., Jaimovich, N. and Siu, H.E. (2021). The growing importance of social tasks in high-paying occupations: implications for sorting. Journal of Human Resources, 58(5), 1429–1451. https://doi.org/10.3368/jhr.58.5.0121-11455R1.

Cunningham, C., Ederer, F. and Ma, S. (2021). Killer acquisitions. Journal of Political Economy, 129(3), 649–702.

De Loecker, J., Obermeier T. and Van Reenen, J. (2024). Firms and inequality. The IFS Deaton Review, 3 (Supplement_1). https://ifs.org.uk/inequality/firms-and-inequality.

De Ridder, M. (2024). Market power and innovation in the intangible economy. American Economic Review, 114(1), 199–251. https://doi.org/10.1257/aer.20201079.

Deming, D.J. (2017). The growing importance of social skills in the labor market. The Quarterly Journal of Economics, 132(4), 1593–1640. https://doi.org/10.1093/qje/qjx022.

Depalo, D. and Lucia Di Addario, S. (2014). Shedding light on inventors’ returns to patents. SSRN Scholarly Paper. https://doi.org/10.2139/ssrn.2572446.

Dossi, G. (2024), Race and science, forthcoming paper.

Edin, P.-A., Fredriksson, P., Nybom, M. and Öckert, B. (2022). The rising return to noncognitive skill. American Economic Journal: Applied Economics, 14(2), 78–100. https://doi.org/10.1257/app.20190199.

Feng, J., Jaravel, X. and Einio, E. (2021). Social push and the direction of innovation. Academy of Management Proceedings, 1, 10143. https://doi.org/10.5465/AMBPP.2021.10143abstract.

Gilbert, R.J. (2022). Innovation matters: competition policy for the high-technology economy. MIT Press.

Giupponi, G. and Machin, S. (2023). Labour market inequality. IFS. https://ifs.org.uk/inequality/labour-market-inequality.

Herkenhoff, K., Lise, J., Menzio, G. and Phillips, G.M. (2024). Production and learning in teams. Econometrica, 92(2), 467–504.

Hirvonen, J., Stenhammar, A. and Tuhkuri, J. (2022). New evidence on the effect of technology on employment and skill demand. SSRN Scholarly Paper. https://doi.org/10.2139/ssrn.4081625.

Jaravel, X. (2023). Marie Curie habite dans le Morbihan: démocratiser l’innovation. Editions Seuil.

Katz, L.F., Roth, J., Hendra, R. and Schaberg, K. (2022). Why do sectoral employment programs work? Lessons from WorkAdvance. Journal of Labor Economics, 40(S1), S249–S291. https://doi.org/10.1086/717932.

Kline, P., Petkova, N., Williams, H. and Zidar, O. (2019). Who profits from patents? Rent-sharing at innovative firms. The Quarterly Journal of Economics, 134(3), 1343–1404. https://doi.org/10.1093/qje/qjz011.

Koning, R., Samila, S. and Ferguson, J.-P. (2021). Who do we invent for? Patents by women focus more on women’s health, but few women get to invent, Science, 372(6548), 1345–1348. https://doi.org/10.1126/science.aba6990.

Lancieri, F., Posner, E.A. and Zingales, L. (2023). The political economy of the decline of antitrust enforcement in the United States. SSRN Scholarly Paper. https://doi.org/10.2139/ssrn.4011335.

Monster (undated). The future of work 2021: global hiring outlook. Accessed 20 February 2024. https://hiring.monster.com/resources/blog/future-of-work-2021-summary.

Nimier-David, E. (2022). Local human capital and firm creation: evidence from the massification of higher education in France. Working paper, 8 September.

Overman, H. and Xu, X. (2022). Spatial disparities across labour markets. IFS. https://ifs.org.uk/inequality/wp-content/uploads/2022/02/Spatial-disparities-across-labourmarkets-IFS-Deaton-Review-Inequality-FINAL.pdf.

Páez, D.G. (2023). The changing nature of work, old-age labor supply, and social security. Job Market Paper, 7 November. https://wdanielgiraldop.github.io/mywebsite/Giraldo_Paez_JMP.pdf.

Schumpeter, J.A. (2008 [1950]). Capitalism, socialism and democracy. Third edition. Harper Collins.

Toivanen, O. and Väänänen, L. (2012). Returns to inventors. The Review of Economics and Statistics, 94(4), 1173–1190. https://doi.org/10.1162/REST_a_00269.

Van Reenen, J. (1996). The creation and capture of rents: wages and innovation in a panel of U.K. companies. The Quarterly Journal of Economics, 111(1), 195–226. https://doi.org/10.2307/2946662.

Weinberger, C.J. (2014). The increasing complementarity between cognitive and social skills. The Review of Economics and Statistics, 96(5), 849–861. https://doi.org/10.1162/REST_a_00449.

Xu, X. (2023). The changing geography of jobs. IFS.

Xu, X., Waltmann, B., Van Der Erve, L. and Britton, J. (2021). London calling? Higher

education, geographical mobility and early-career earnings. IFS. https://doi.org/10.1920/re.ifs.2021.0198.